Car crashes are almost always started by one vehicle hitting another one. Often, the driver who crashed into the other car is found at fault for the accident.

Car crashes are almost always started by one vehicle hitting another one. Often, the driver who crashed into the other car is found at fault for the accident.

Sometimes, a car accident is not caused by a collision. If another driver brakes or changes lanes unexpectedly, you may swerve or brake to avoid hitting that car. If your reaction causes you to crash into another car, or a car collides with you, you have just been in a no-contact car crash. There are many other examples of no-contact car accidents.

No-contact crashes usually do not occur without the negligence of another driver, even though that driver did not hit your vehicle. However, you could also get into an accident because of a defective part or negligent repair work. In those types of cases, you may have grounds for a product liability claim against a product manufacturer or a negligence claim against the mechanic.

Much like victims of hit-and-run accidents, victims of no-contact crashes may wonder if they can pursue compensation for their injuries and other losses. The answer to this question is based on various factors, which you should discuss with your Bloomington car accident lawyer. The initial consultation with an attorney from TSR is free.

Causes of No-Contact Crashes

There are many reasons a no-contact crash could occur. Here are some of the most common:

- A driver cuts you off and you make an evasive maneuver only to hit a third vehicle

- A driver changes lanes without signaling, forcing you to maneuver out of the way

- You get run off the road or into another vehicle when someone changes lanes without looking

- A left-turning driver cuts across your path, forcing you to swerve to avoid a crash, only to collide with someone else

- The driver in the car directly in front of you stops suddenly and you get in an accident while trying to move out of the way

- You are in the lane of merging traffic when another driver, who is not paying attention, is about to sideswipe you. You slow down, but get rear-ended

No-contact crashes may also involve fixed objects, and not just other vehicles. For example, you could maneuver to avoid a collision and hit a tree or a road sign. You could also hit a concrete light post.

Often, the driver who caused you to crash is unaware of what happened. This person is likely to just keep on driving without looking back. That is why these drivers are sometimes referred to as phantom drivers, because they essentially disappear after the crash happens.

Filing a No-Contact Car Crash Claim

Sometimes other drivers realize they contributed to a collision and they stop at the scene. If this happens, you may be able to file a claim the same way you would for any other type of crash. Minnesota is a no-fault state so you would turn to your personal injury protection coverage to pay for medical expenses, lost wages and replacement services.

Minnesota also requires drivers to purchase uninsured motorist coverage in case they are involved in an accident with a driver who lacks insurance. This coverage can also be used for a hit-and-run collision since a no-contact crash is considered a type of hit-and-run crash. However, it does not cover damage to your vehicle.

Steps After the Crash

Make sure to call the police at the scene so they can investigate and complete a report. They may also be able to locate the driver if you can provide a description of the driver and/or the vehicle he or she was in. Immediately after the crash, jot down what you remember about the vehicle that instigated the crash before you forget, particularly the license plate of the vehicle. Some insurance companies have disclaimers that if you do not call the police and make a report you cannot make an uninsured motorist claim.

Ask for the contact information of any witnesses at the scene. You can also record your conversation with them, with their permission of course.

Our attorneys can talk to the insurance company on your behalf. However, if they may contact you before you talk to a lawyer, it is important to be very careful with what you say. They are likely to ask you to describe what happened, and certain things you say could make it sound like you are to blame for what happened.

Avoid statements like:

- “I should have…”

- “I did not see him until the last second.”

- “I was following a little too closely…”

- “I was tired.”

- “I was in a rush.”

While some of these statements may be true, they may have no bearing on the crash. The attorneys at TSR Injury Law are focused on your best interests. The information we discuss is confidential, which means the insurance company cannot gain access to it.

If you make statements like the ones above to the insurance company, they will likely try to pin the crash on you, or at least say you are partially to blame.

Our attorneys are committed to ensuring you are not assigned more fault than you deserve. Any fault you are assigned reduces the value of any settlement you may be awarded.

Injured in a No-Contact Crash? We are Here to Help

Our experienced attorneys have extensive knowledge of Minnesota laws that apply to no-contact car crashes, including laws on insurance coverage and partial fault for an injury.

We are prepared to help you pursue maximum compensation and determine if you have a valid claim when you meet with us for your initial consultation. This meeting is free and there is no obligation for you to take legal action.

TSR has a proven track record of recovering compensation for car crash victims.

Need help? Give us a call today. (612) TSR-TIME

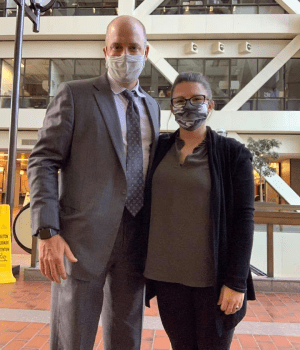

Earlier this month, Partner Rich Ruohonen had a three-day trial in Hennepin County. This was the first civil trial in the State of Minnesota during the COVID-19 pandemic. It was different – plexiglass was everywhere, masks were mandatory, and jurors were sitting spread out around the courtroom and forced to stand behind the podium. We all felt safe with the precautions taken but it was weird! TSR continues to be a great leader in our civil justice system!

Earlier this month, Partner Rich Ruohonen had a three-day trial in Hennepin County. This was the first civil trial in the State of Minnesota during the COVID-19 pandemic. It was different – plexiglass was everywhere, masks were mandatory, and jurors were sitting spread out around the courtroom and forced to stand behind the podium. We all felt safe with the precautions taken but it was weird! TSR continues to be a great leader in our civil justice system!

The goal of a personal injury claim is to recover compensation for the damages suffered by the victim. A large percentage of those damages are the medical bills for treatment of your injuries. If your claim is successful, and your lawyer pursues full compensation, your past bills will be paid off and your future bills accounted for.

The goal of a personal injury claim is to recover compensation for the damages suffered by the victim. A large percentage of those damages are the medical bills for treatment of your injuries. If your claim is successful, and your lawyer pursues full compensation, your past bills will be paid off and your future bills accounted for. Is a car insurance company legally allowed to cancel a policy and deny coverage based on allegations the policyholder committed fraud when he or she obtained the policy?

Is a car insurance company legally allowed to cancel a policy and deny coverage based on allegations the policyholder committed fraud when he or she obtained the policy? Car crashes are almost always started by one vehicle hitting another one. Often, the driver who crashed into the other car is found at fault for the accident.

Car crashes are almost always started by one vehicle hitting another one. Often, the driver who crashed into the other car is found at fault for the accident. The MnFORE Golf Tournament went on yesterday at the Bearpath Golf & Country Club, starting at 10:30 a.m. TSR Injury Law sponsored a hole at the tournament. Proceeds go to benefit programs that are meant to help firefighters and their families. As first responders, they often have the worse on job injuries and long term health issues.

The MnFORE Golf Tournament went on yesterday at the Bearpath Golf & Country Club, starting at 10:30 a.m. TSR Injury Law sponsored a hole at the tournament. Proceeds go to benefit programs that are meant to help firefighters and their families. As first responders, they often have the worse on job injuries and long term health issues. While medical bills, wage loss and pain and suffering are usually the largest percentage of the compensation from a car crash claim, the cost of repairing or replacing your vehicle can also be significant. It is also usually the first part of the claim against the at-fault party to be settled.

While medical bills, wage loss and pain and suffering are usually the largest percentage of the compensation from a car crash claim, the cost of repairing or replacing your vehicle can also be significant. It is also usually the first part of the claim against the at-fault party to be settled.